What comes to your mind when you hear the term “credit report”? Does it make you think of a statement that shows your credit history? If so, then you’re on the right track!

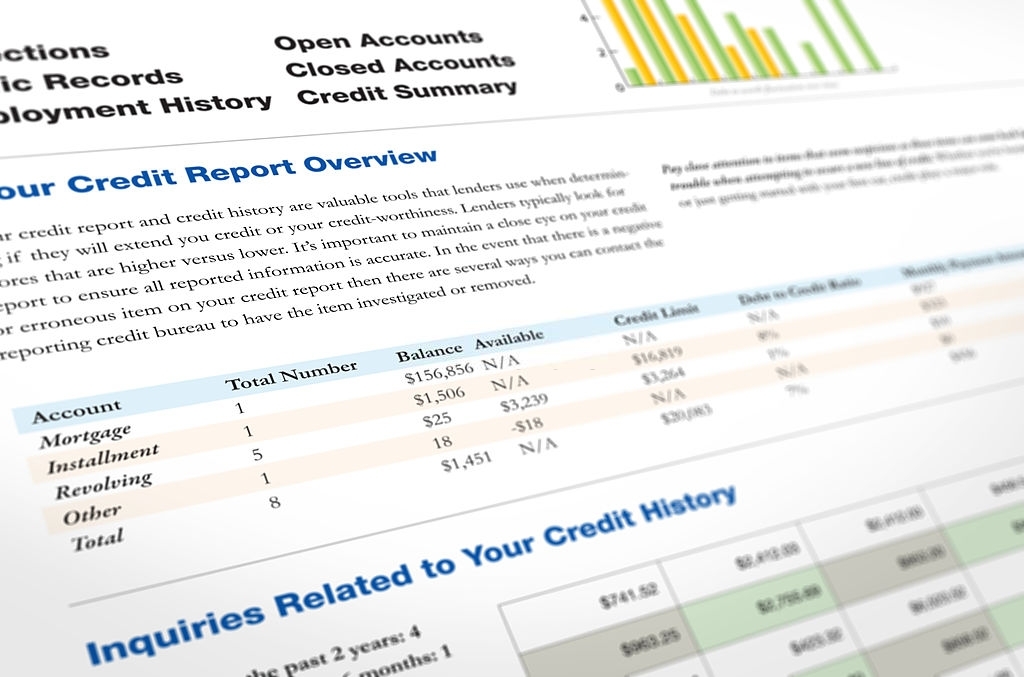

A credit report is a detailed summary of your credit history and current credit situation. It is a detailed breakdown of your credit activity, such as loan paying history and the status of your credit accounts, prepared by a credit bureau.

Your credit report includes a record of your loan accountability, how and when you pay your bills, how much debt you owe, and how long you have been managing your credit accounts. Think of it as your school report, but instead of your courses and CGPA, this carries your loan paying history and your credit account situation.

Credit bureaus, also known as credit reporting agencies, collect and store financial data about you that creditors, such as lenders, credit card companies, and other financial companies, submitted to them, and create credit reports with that information. CreditRegistry is a credit bureau.

Credit reports contain information that includes but is not limited to name, date of birth, address, phone number, unique identification number, type of credit account(s), credit payment limits and balances, credit performance, credit score, and other public records.

When you apply for a loan from a financial institution, how do you think they determine your eligibility for the loan? Be rest assured that they don’t look at your face. They don’t check your marital status either. They certainly don’t need your academic qualifications.

They ascertain your creditworthiness by conducting credit checks on you! Credit checks mean that your financial institution looks at information from your credit report to understand your financial behavior and determine your creditworthiness.

Banks and other lenders access your credit report to inform their decision about your loan application; whether or not they should loan you money and at what interest rates. Lenders also use your credit report to determine whether you’ll continue to meet the terms of an existing credit account.

Other businesses and entities such as potential employers, landlords, insurance institutions, and lease companies, may also access your credit reports to help them decide if they would offer you a job, mortgage, expand your insurance covers, a lease, or provide you with cable TV, internet, utility, or cell phone service. Credit reports are also used to calculate your credit score, verify your identity, and for other purposes within certain limits defined under the federal law of Nigeria.

It is important that you check your credit score regularly, to ensure your credit information is correct and up to date, and to track your credit account situation and eligibility for credit opportunities.

Check your credit report today, tap here!

[…] report because it is a key tool used by lending agencies. It is important to keep an eye on your credit report. That is the basis of your SMARTScore, so reviewing it at least once a year and correcting any […]

To check my credit report