Remember the days of school, where grades and cumulative grade point averages (CGPAs) played a significant role in determining our academic progress? Just as grades served as indicators of our academic performance, SMARTScores now step in as the GPA for life's major decisions. SMARTScores, like a grade or CGPA on a report card, provide a summary of an individual's creditworthiness and financial responsibility, providing invaluable insights into their ability to fulfill financial commitments. Generated by credit bureaus like CreditRegistry, these SMARTScores are based on an individual's credit history, payment patterns, and financial behaviour. Just as grades reflected our study habits and performance, SMARTScores offer a comprehensive measure of creditworthiness, enabling lenders, landlords, and employers to assess risks and make informed decisions. By understanding the factors that influence SMARTScores, we gain insight into our financial strengths and areas for improvement. In this blog, we will explore the transformative role of SMARTScores in major life decisions.

Securing a loan is a significant milestone, much like acing a final exam. SMARTScores serve as the financial transcripts that lenders analyze to evaluate an individual's creditworthiness, repayment history, and financial stability. Just as impressive grades instill confidence in teachers, high SMARTScores instill confidence in lenders, making loan approval more likely. SMARTScores unlock financial opportunities, allowing individuals to access the funds they need to pursue their dreams, just as exceptional academic performance opens doors to educational opportunities.

Finding the perfect home is similar to submitting transcripts and recommendation letters when applying for a prestigious program, SMARTScores play a vital role in rental applications. Landlords often consider SMARTScores to assess an applicant's financial responsibility, payment history, and potential reliability as a tenant. Much like an outstanding academic record, a strong SMARTScore sets applicants apart, increasing their chances of securing their dream home. It also ensures a transparent and streamlined rental process, benefiting both landlords and responsible tenants.

Just as our academic achievements influenced our career prospects, SMARTScores can impact our professional lives. Employers are increasingly utilizing credit checks and SMARTScores as part of their screening processes. Some employers often consider credit history as an indicator of financial responsibility and integrity. This emphasizes the importance of maintaining a positive credit profile and making wise financial decisions that can shape our career opportunities.

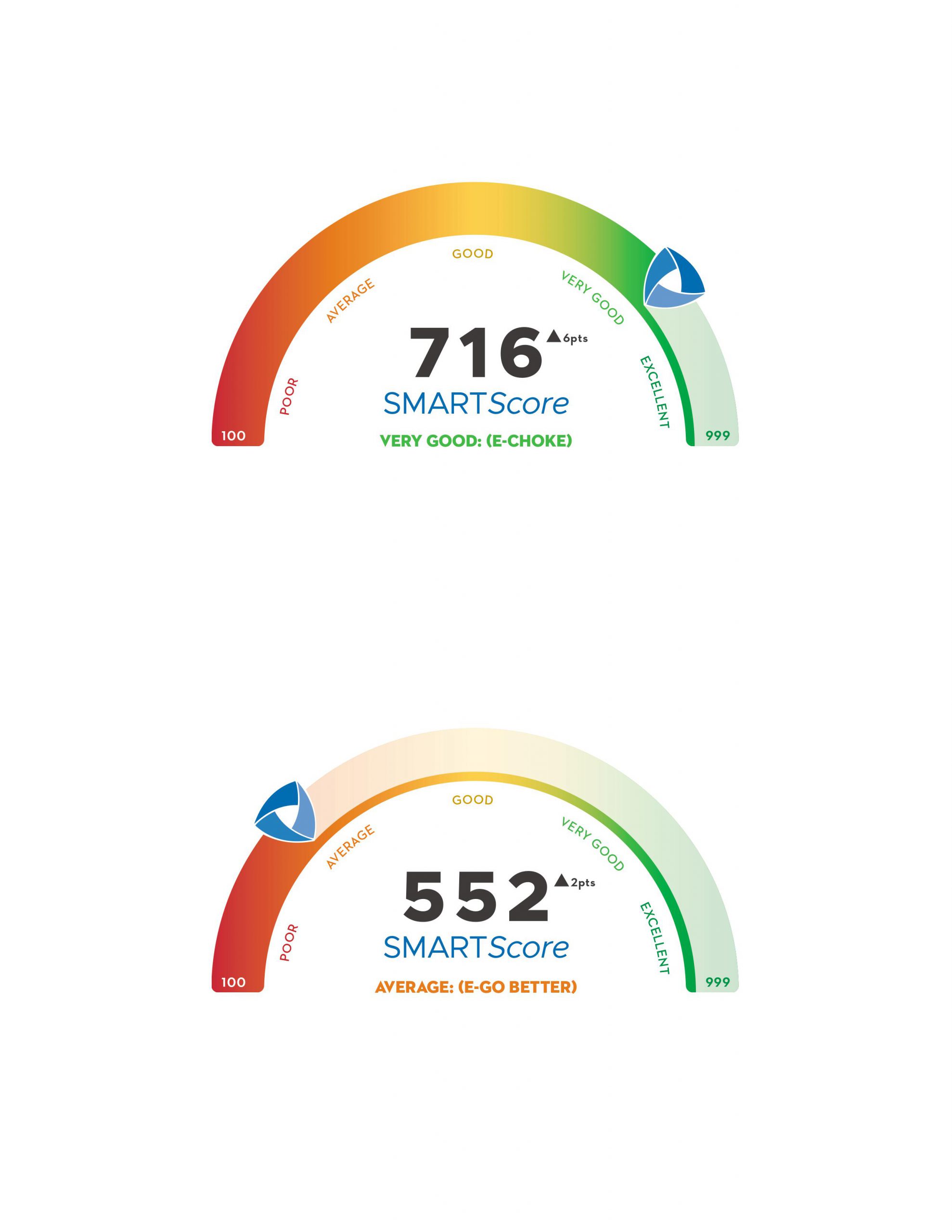

Much like striving for better grades and aiming for a higher CGPA, SMARTScores serve as a motivational tool for personal financial growth. A low SMARTScore can act as a wake-up call, prompting individuals to reassess their financial habits, rectify past mistakes, and embark on a journey towards financial stability. By monitoring and improving their SMARTScores, individuals can unlock better interest rates, increase borrowing capacity, and enhance financial opportunities. SMARTScores encourage responsible financial behaviour, providing a roadmap for a brighter financial future.

In an interconnected world where major life decisions are based on trust, reliability, and financial responsibility, SMARTScores emerge as a vital tool. From securing loans to renting homes and even landing jobs, SMARTScores offer a comprehensive evaluation of an individual's creditworthiness and responsible behaviour. By understanding and nurturing our SMARTScores, we gain the power to shape our financial destinies, secure the opportunities we deserve, and navigate major life decisions with confidence. Embrace the power of SMARTScores, and let them guide you towards a successful and fulfilling life. To unlock the power of your SMARTScore and improve your financial "grade", you need a comprehensive credit report from CreditRegistry.