Are you looking to borrow money or apply for credit in Nigeria? If so, it's important to understand the role of credit bureaus in the lending process. Credit bureaus play a crucial role in determining your creditworthiness and can affect your ability to access loans and other forms of credit. In this blog post, we'll explore the importance of credit bureaus in Nigeria and why you need to know about them.

Credit bureaus are organizations that collect and analyze financial information about individuals and businesses. This information helps create credit reports and credit scores, which are used by lenders to determine creditworthiness. In Nigeria, CreditRegistry is a credit bureau that operates under the regulation of the Central Bank of Nigeria (CBN).

Credit bureaus play a critical role in the lending process. They help lenders assess the creditworthiness of borrowers by providing accurate and up-to-date information about their credit history, including their payment history, outstanding debts, and credit limits. This information determines the borrower's credit score, which is a numerical representation of their creditworthiness.

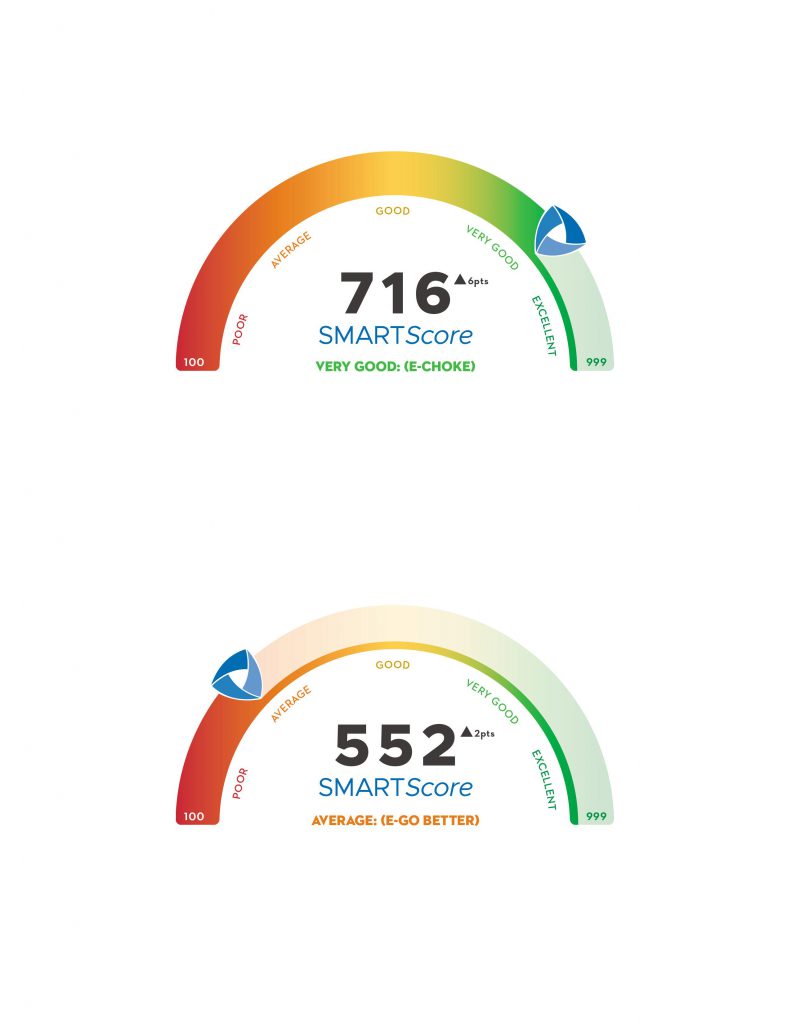

Credit scores help lenders to make decisions about whether or not to approve a loan or credit application. These scores also determine the interest rate and repayment terms for the loan. Borrowers with higher credit scores are considered less risky and are more likely to be approved for loans with lower interest rates and more favorable repayment terms. On the other hand, borrowers with lower credit scores may be considered higher risk and may be offered loans with higher interest rates and less favorable repayment terms.

Credit bureaus collect financial information from a variety of sources, including banks, and other lenders. This information is translated into create credit reports, which contain detailed information about the borrower's credit history.

Credit bureaus use this information to calculate credit scores, which are based on a variety of factors, including payment history, credit utilization, length of credit history, and the types of credit used. The SMARTScore is a three-digit number that ranges from 300 to 900. In Nigeria, a score of 700 and above is generally considered good, while a score below 500 is considered poor.

If you're looking to improve your credit score, there are several steps you can take. First, make sure to pay your bills on time every month, including credit card bills, loan payments, and utility bills. Late or missed payments can significantly damage your credit score and stay on your credit report for up to 7 years.

Next, try to keep your credit utilization low. This means avoiding using too much of your available credit at once and aiming to keep your credit utilization below 30%. You can also improve your credit score by building a positive credit history. This means having a track record of responsible borrowing and repayment, including paying your bills on time, keeping your credit utilization low, and avoiding defaults, bankruptcies, and other negative marks on your credit report.

Finally, it's important to check your credit report for errors or inaccuracies that could be dragging your score down. If you find any errors on your credit report, you can dispute them with the credit bureau or the creditor in question to have them corrected or removed

Credit bureaus play a crucial role in the lending process in Nigeria. They help lenders assess the creditworthiness of borrowers and determine the interest rate and repayment terms for loans and other forms of credit.

Understanding the role of credit bureaus in Nigeria is crucial to managing your creditworthiness and achieving your financial goals. By familiarizing yourself with the credit reporting process, monitoring your credit report regularly, and taking steps to improve your credit score, you can increase your chances of accessing better loan rates and credit terms.

If you haven't already, it's time to take control of your credit by getting a copy of your credit report from CreditRegistry. Don't wait until you're denied credit or offered unfavorable terms - get ahead of the game and know where you stand. Take the first step towards financial empowerment today and order your credit report here.